What is Dependent Care Flexible Spending?

Many parents work for a company that has a Flexible Spending option (also called Flex Spending). A flexible spending account lets you have money deducted from your payroll. It is then in a special account to pay for certain items tax-free.

There are typically two types of flexible spending accounts.

Medical Flexible Spending is for doctor’s visits, medicine, and other medical expenses.

There is also Dependent Care Flexible Spending which is for work-related expenses like daycares, nannies, babysitters, and yes, day camps.

Which Camps are Eligible for Dependent Care Flexible Spending?

IRS Federal Publication 503 says (on page 7) “The cost of sending your child to an overnight camp is not considered a work-related expense. The cost of sending your child to a day camp may be a work-related expense, even if the camp specializes in a particular activity, such as computers or soccer.”

- For day camps, the child must be under the age of 13 or have a disability.

- If your child does not spend the night at camp, it is most likely a day camp.

- Note: Overnight camps are also called Residential camps.

How Do I Get Reimbursed For a Day Camp?

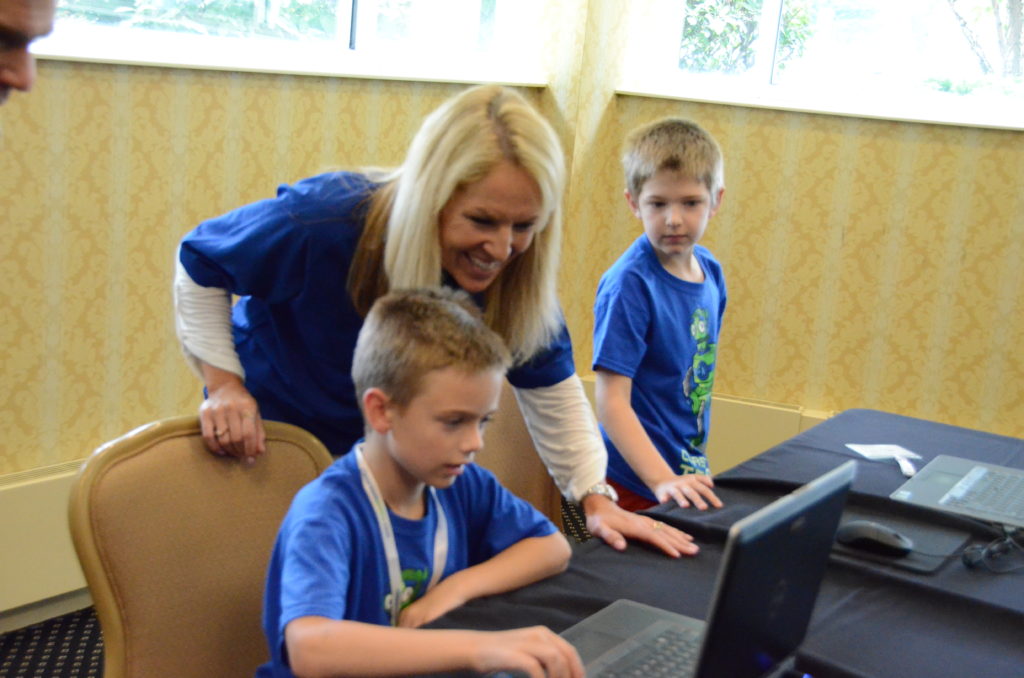

You will need your camps Federal EIN number (also called a Tax ID number) and street address in order to process your claim. For Classroom Antics, this information is on your original camp receipt.

Again, note eligible dependents for flexible spending are restricted to children under 13. However, each employer’s flexible spending rules are different. So, contact your HR coordinator for details on your plan. Also, sometimes your benefit information is online.

Are Our Camps Eligible for Flexible Spending?

Yes, our in-person summer camps qualify. Our camps are for kids under 13 and day camps. If you have funds set aside for dependent care for this year and would like to join us in a camp, then check out the camps available by clicking on the link below.